"When China's tinderbox economy implodes, who will be left to bid up the world's surplus commodities and real estate?

After 30 years of torrid expansion, perhaps the single most consequential factor in China’s economy is how much of it is a “black box”: a system with visible inputs and outputs whose internal workings are opaque.

There are number of reasons for this lack of transparency:

1. Official statistics reflect what officials want to project, not the unfiltered data.

2. Policy decisions are made behind closed doors by a handful of leaders.

3. There is little institutional history of transparency.

4. Many important statistics are self-reported and prone to distortion.

5. Large sectors of the economy are informal and difficult if not impossible to measure accurately.

6. Endemic corruption distorts critical economic yardsticks.

7. There is little historical precedent to guide policy makers and individual investors.

None of these is unique to China, of course, with the possible exception of #7: few nations in history (if any) have experienced an equivalent boom in infrastructure, credit, housing and wealth in such a short span of time.

Saving Face By Editing Data

As anyone who has lived and worked in Asia can attest, public perception (i.e. "face") is of paramount concern. There is tremendous pressure to put a positive spin on everything in the public sphere. Negative publicity causes not just the individual to lose face, but his boss, agency, company and family may also be tarnished.

For this reason, reporting potentially negative numbers accurately may put careers and hopes for advancement at risk.

This accretion of fear of reprisal/disapproval builds as it moves up the pyramid of command. This process can lead to tragic absurdities being taken as truth. In one famous example in Mao-era China, officials ordered rice planted in thick abundance along a particular stretch of road, so that when Chairman Mao was driven along this roadway, he would see evidence of a spectacular rice harvest.

In reality, China was in the grip of a horrific famine resulting from disastrous state policies (The Great Leap Forward). But since everyone feared the consequences of telling Mao his policies were starving millions of Chinese people, the fields along the highway was planted to mask the unwelcome reality.

Even the most honest reports reflect the biases of those summarizing feedback for their superiors. As a result, when the feedback finally reaches the top leadership, it may be inaccurate or misleading in ways that are difficult to detect.

The Dangers Of Opaque Leadership Decisions

All leaders have their own biases and experiential limits, and left unchecked by accurate feedback and honest dissent, these have the potential to generate disastrous decisions.

Perhaps the top leadership in China is soliciting honest dissent, but without a vigorously free media and multiple unedited feedback loops, this is unlikely for systemic reasons.

Most people—leaders and followers alike—seek to confirm their own views (i.e. confirmation bias). A system in which key decisions are not aired publicly and the trustworthiness of the data being considered behind closed doors is also unknown is a system designed to reinforce confirmation bias and yes-men.

In this environment, destructive policies may be supported by the chain of command despite the consequences.

Lack Of Institutional History of Transparency

Institutions with a long history of independence and a policy of priding transparency have the potential to counter the tendency of hierarchies to encourage confirmation bias and fudged feedback.

But China’s tumultuous history in the 20th century—invasion, foreign occupation, civil war, revolution, mass famines, the Cultural Revolution’s mass disruptions and purges, the end of Mao’s Gang of Four and Deng Xiaoping’s “to get rich is glorious” reforms—has not been conducive to the establishment of independent institutions.

Developing the independence of institutions in the midst of such unprecedented political, social and economic turmoil is a long-term work in progress. Though no comparison is entirely analogous, we can look at the first equally tumultuous 30 years of the American Republic (1790 – 1820) and the French Republic (1789-1819) for historical examples of the difficulties in establishing enduringly independent institutions.

Self-Reported Statistics

Self-reported data plays a significant role in any economic snapshot that measures sentiment and expectations. But when it comes to income, outstanding loans and other data, there’s no substitute for accurate numbers.

As a general rule, the larger the informal cash economy and the greater the leeway and the incentives to under-report, the lower the quality of self-reported statistics.

Take income as an example. In the U.S., the vast majority of non-cash income is reported directly to the tax authorities: wages, 1099s, sales of securities, etc. The leeway to fudge income is low, which pushes the incentives to fudge onto the expense/deduction side of the ledger. For this reason, IRS income data is more trustworthy than self-reported measures of income and employment.

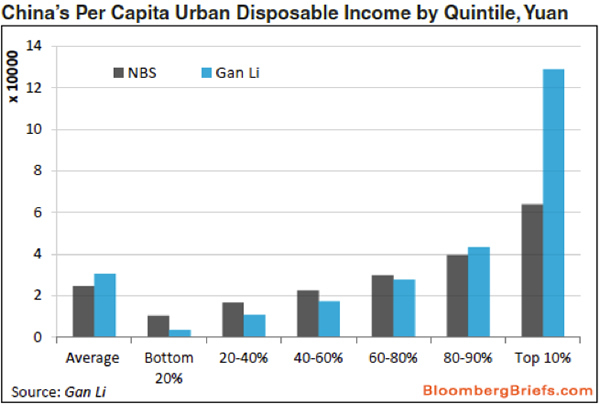

Consider this chart of household income in China. A survey of households found incomes were much higher than the officially collated numbers. In the case of the top earners, the difference was significant enough to skew a variety of key numbers such as household income as a percentage of GDP.

(Source)

The differences between official data and data collected by surveys is troubling for a number of reasons... ."

No comments:

Post a Comment