A number of key data points suggest the US is entering another recession. These data points are:

1) The Empire Manufacturing Survey

2) Copper’s sharp drop in price

3) The Fed’s own GDPNow measure

4) The plunge in corporate revenues

Why does this matter? After all, the US typically enters a recession every 5-7 years or so.

This matters because interest rates are currently at zero. Never in history has the US entered a recession when rates were this low. And it spells serious trouble for the financial system going forward.

Firstly, with rates at zero, the Fed has little to no ammo to combat a contraction. Some Central Banks have recently cut rates into negative territory. However, this is politically impossible in the US, particularly with an upcoming Presidential election.

This ultimately leaves QE as the last tool in the Fed’s arsenal to address an economic contraction.

However, at $4.5 trillion, the Fed’s balance sheet is already so monstrous that it has become a systemic risk in of itself. And the Fed knows this too… Janet Yellen, before she became Fed Chair, was worried about how the Fed could safely exit its positions back when its balance sheet was only $1.3 trillion during QE 1 in 2009.

Moreover, it’s not clear that the Fed could launch another QE program at this point. For one thing there is that aforementioned upcoming Presidential election. Another QE program would just be fuel for the fire that is growing public anger with Washington’s meddling in the economy. And this would lead to greater scrutiny of the Fed and its decision making.

Even if the Fed were to launch another QE program in the next 15 months, it’s not clear how much it would accomplish. A psychological shift has hit the markets in which investors’ faith in Central Bank policy is no longer sacrosanct.

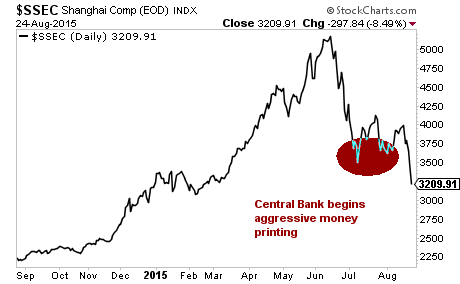

Consider China, where despite rampant money printing, the stock market has continued to implode, crashing to new lows. China’s Central Bank is pumping $29 billion into its stock markets per day. This bought a few weeks of a bounce before Chinese stocks continued to collapse.

In short, as we predicted, Central Banks will indeed be powerless to stop the next Crisis as it spreads. The Fed could potentially go “nuclear” with a massive QE program if the markets fall far enough, but this would only accelerate the pace at which investors lose confidence in Central Banks’ abilities to rein in the carnage.

Smart investors should start preparing now. What happened on Monday was just a taste of what's coming...."

Graham Summers

Phoenix Capital Management

No comments:

Post a Comment