December 22, 2016

"'Bail-Ins' Are Now Spreading Throughout the Banking System

Italy has now joined the “bail-in” crowd.

Monte dei Paschi di Siena is to be rescued by the Italian state using a new €20bn bailout package, as a last-gasp private sector rescue plan for the world’s oldest bank looked set to fail, forcing losses on bondholders.

The government rescue, which had long been resisted in Rome, is designed to draw a line under the slow-burn crisis in Italian banking that has alarmed investors and become the main source of concern for European financial regulators.

Source: Financial Times

In this particular case, the bail-in will use bondholders’ money. But depositors will be on the hook in future cases in Europe.

Those who are shocked by this development are not paying attention. The template for this manner of dealing with financial issues was first laid out in Cyprus in 2012-2013.

Anyone who wants to understand how the next global banking crisis will unfold should take heed.

The quick timeline for what happened in Cyprus is as follows:

• June 25, 2012: Cyprus formally requests a bailout from the EU.

• November 24, 2012: Cyprus announces it has reached an agreement with the EU the bailout process once Cyprus banks are examined by EU officials (ballpark estimate of capital needed is €17.5 billion).

• February 25, 2013: Democratic Rally candidate Nicos Anastasiades wins Cypriot election defeating his opponent, an anti-austerity Communist.

• March 16 2013: Cyprus announces the terms of its bail-in: a 6.75% confiscation of accounts under €100,000 and 9.9% for accounts larger than €100,000… a bank holiday is announced.

• March 17 2013: emergency session of Parliament to vote on bailout/bail-in is postponed.

• March 18 2013: Bank holiday extended until March 21 2013.

• March 19 2013: Cyprus parliament rejects bail-in bill.

• March 20 2013: Bank holiday extended until March 26 2013.

• March 24 2013: Cash limits of €100 in withdrawals begin for largest banks in Cyprus.

• March 25 2013: Bail-in deal agreed upon. Those depositors with over €100,000 either lose 40% of their money (Bank of Cyprus) or lose 60% (Laiki).

The most important thing I want you to focus on is the speed of these events.

Cypriot banks formally requested a bailout back in June 2012. The bailout talks took months to perform. And then the entire system came unhinged in one weekend.

One weekend. The process was not gradual. It was sudden and it was total: once it began in earnest, the banks were closed and you couldn’t get your money out (more on this in a moment).

There were no warnings that this was coming because everyone at the top of the financial food chain are highly incentivized to keep quiet about this. Central Banks, Bank CEOs, politicians… all of these people are focused primarily on maintaining CONFIDENCE in the system, NOT on fixing the system’s problems.

Indeed, they cannot even openly discuss the system’s problems because it would quickly reveal that they are a primary cause of them.

If you believe that this kind of issue cannot hit the US, you are mistaken. The FDIC has already proposed legislation that would permit authorities to freeze accounts and use them to "bail-in" banks when the next Crisis hits.

If you are not already preparing your wealth for these sorts of potential risks, you need to start thinking about it now...."

Graham Summers

Chief Market Strategist

Phoenix Capital Research

“Someday financial markets will decline...rising stock/bond markets will no longer be government policy. QE will end and money won’t be free. Corporate failure will be permitted. The economy will turn. Someday, somewhere, somehow, investors will lose money and once again come to favor capital preservation over speculation. Someday, interest rates will be higher, bond prices lower, and the prospective return from owning fixed-income instruments will again be commensurate with risk.” Seth Klarman

Thursday, December 22, 2016

Tuesday, November 15, 2016

Thursday, October 6, 2016

DEBT: Why is it that the ABLE seem to DISABLE?

DEBT: the able, disable... "Anemic global growth is “sets stage...lower growth hampers deleveraging...debt overhang exacerbates slowdown,”

http://blogs.wsj.com/economics/2016/10/05/three-risks-to-the-global-financial-system-as-debt-hits-record-levels/

WSJ

http://blogs.wsj.com/economics/2016/10/05/three-risks-to-the-global-financial-system-as-debt-hits-record-levels/

WSJ

Gary Shilling Blog: It's not going to be pretty

Gary Shilling Blog: It's not going to be pretty: We have a situation where most people in Europe and North America have seen declines in their purchasing power for over a decade. When we ...

Wednesday, July 13, 2016

"Yes, The Economy Is Actually That Bad"

"...debt is a two-edged sword and that if additional indebtedness doesn’t work to create income to pay down interest and principle, it is a no-win deal."

"Debt. It’s good, it’s bad, there’s too much of it, the government keeps piling on more of it. What’s the deal?

You may have none, you may have too much, but one thing is certain, debt is a major driving force behind the world economy. Both in our personal lives and in the lives of immense corporations struggling to hold on in an ever-changing economy. Make no mistake, debt patterns will continue to shape all of our financial landscapes.

Given this unavoidable fact of life, when we had the chance to sit down with Dr. Lacy Hunt of Hoisington Investment Management to discuss his upcoming appearance at our Irrational Economic Summit in October, debt is where we began.

U.S. consumers have racked up almost $1 trillion in credit card debt, despite some saying this is a great sign, that this means consumers are optimistic and will buoy the economy, Dr. Hunt does not agree.

He immediately points out that debt is a two-edged sword and that if additional indebtedness doesn’t work to create income to pay down interest and principle, it is a no-win deal.

See, when you agree to spend borrowed money today, you’re leveraging that against your future income. That means that the dollars you’ll earn tomorrow are already spent and will not be there to use in the future for anything else. Seems obvious, right?

Of course, this is not a problem if you expect your income to increase as time marches along and your payments become due. But how many people in America are facing an increase in personal income when the standard of living hasn’t changed one iota in 20 years? Not many.

Unfortunately, this is not on the forefront of most people’s thoughts when they go to buy something like a new car. Dr. Hunt points out that new car sales are buoying portions of the economy, but that credit-lending standards have slipped, much like they did for mortgages prior to the housing crisis in 2008 (Harry has been talking about the auto sector soon getting turned on its head for months!).

To illustrate this, Dr. Hunt points out that the average automobile loan has gone from six years to eight in order to allow less qualified buyers to purchase more expensive cars than they might otherwise have been able to afford.

This allows buyers to make smaller payments over a longer term, but also exposes them to the risk of missing any one of those 96 monthly payments.

But what about student debt? That has always been one way to invest in ourselves, and our children, and foster new revenue streams to pay down interest and principal. Dr. Hunt has bad news on that front, as well.

From Dr. Hunt’s interview with Rodney Johnson:

Unfortunately, the economy is performing so poorly that a lot of our college graduates are coming out and they’re having to settle for jobs that are not much better than what they would’ve received if they had gone directly into the labor force from high school.

Even classically “good debt” like a college education has become a non-performing investment. That’s scary because Dr. Hunt also points out that this deluge of debt, and our eagerness both as a country and as consumers to incur the “wrong type of debt” is killing growth.

This debt is slowing GDP growth and the growth of our personal incomes and investments. “That’s why”, Dr. Hunt points out, “the standard of living is unchanged from where it was 20 years ago....”

Robert Johnson

Editorial Director, Dent Research

Ref: http://economyandmarkets.com/economy/debt/dr-lacy-hunt-debt-irrational-economics/ (Forget! advertising.)

Wednesday, June 1, 2016

Are YOU Ready?

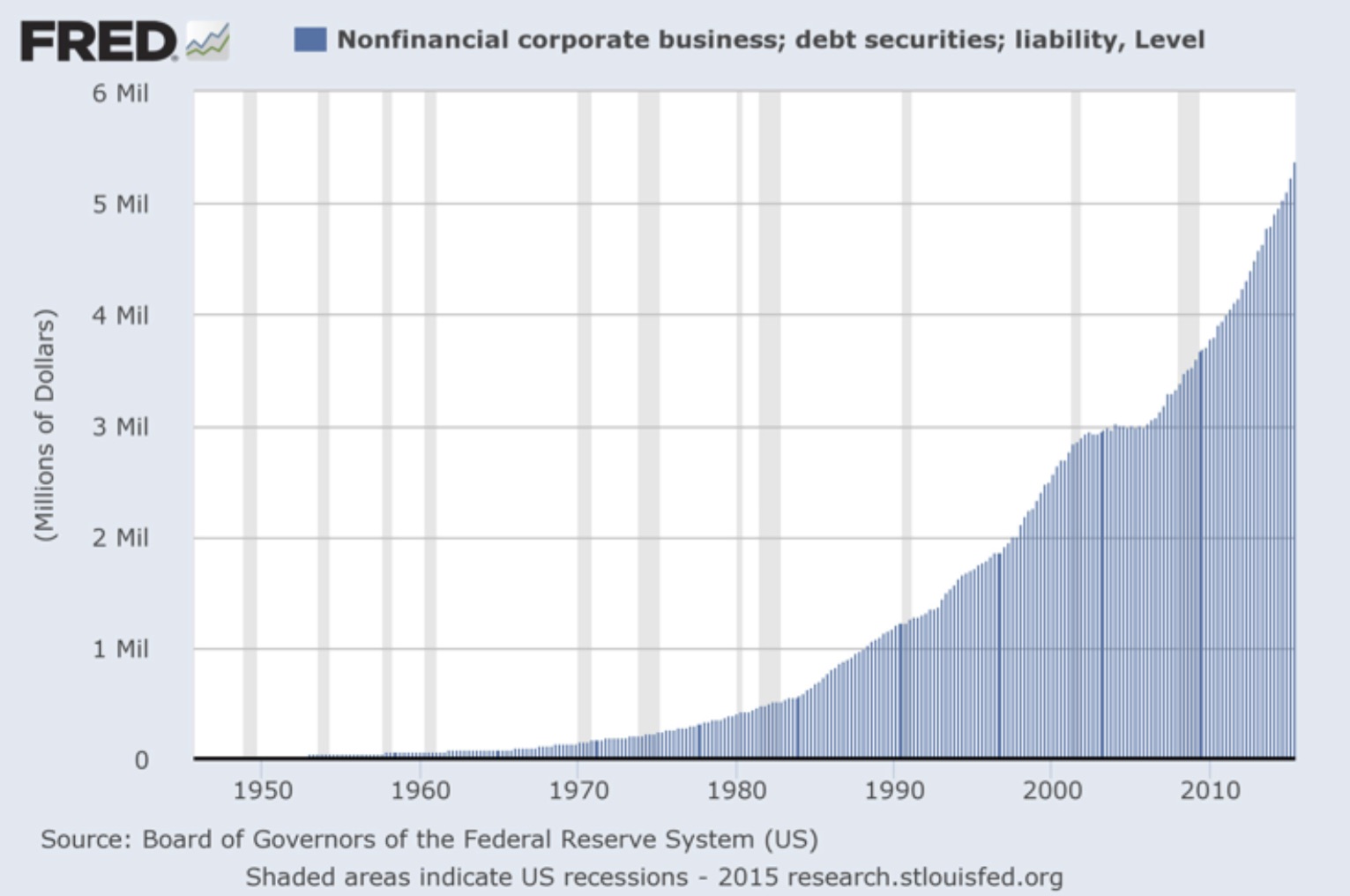

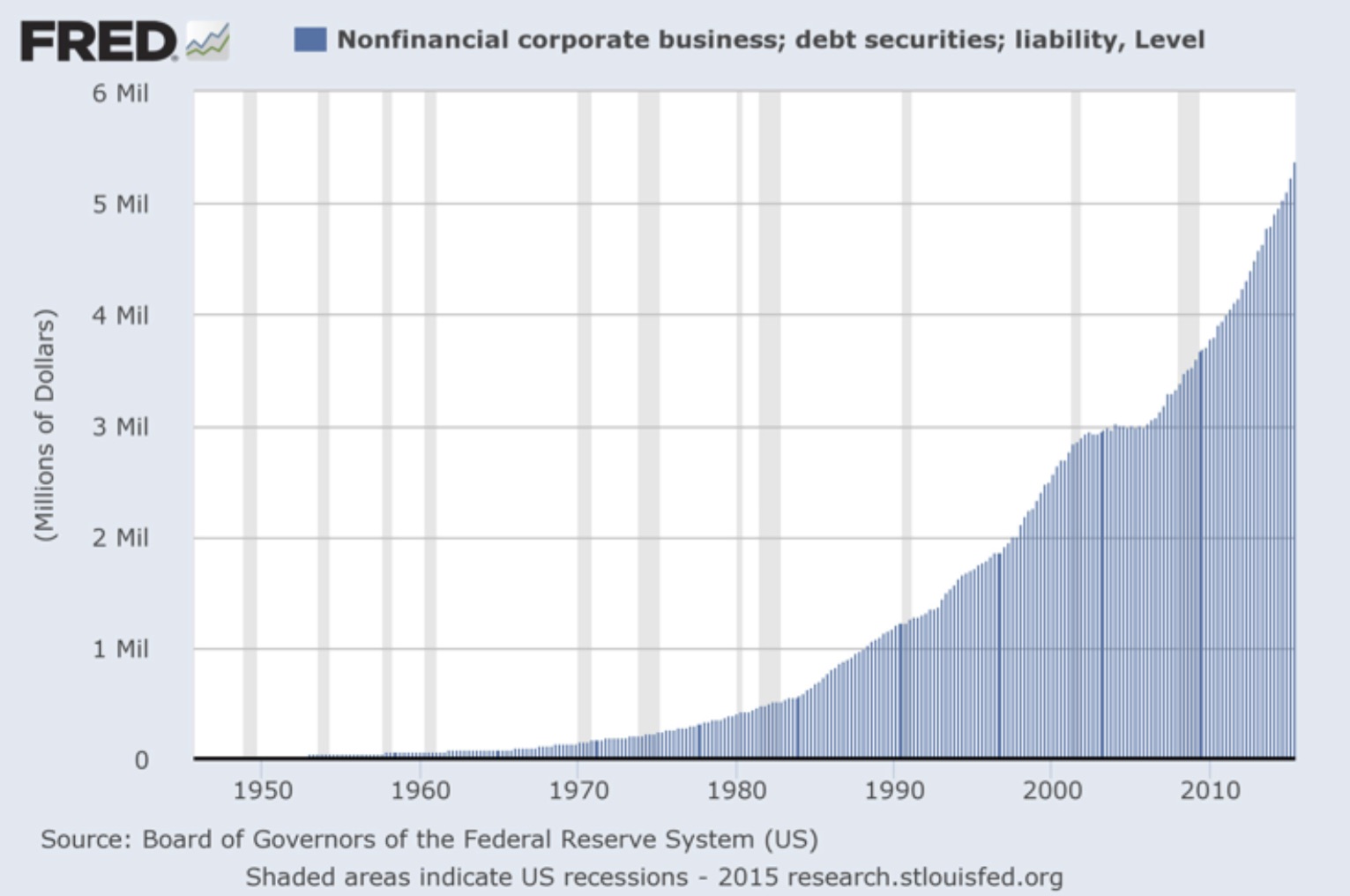

The $6 TRILLION Corporate Debt Implosion Begins in T-Minus

3...2...?

"The corporate bond market is a time bomb waiting to go off.

It took the US half a century to grow its corporate bond market to $3 trillion.

Thanks to the Fed implementing ZIRP and holding rates there for seven years, we’ve doubled the corporate bond market, adding another $3 trillion in corporate debt… since 2009.

These bonds are junk… literally. The average credit rating is junk. All told, since 2012, 75% of companies accessing the bond market have had a credit rating of single-B.

So… if the corporate bond market is now TWICE as large as it was in 2008. And the quality of the bonds is lower than it was at the PEAK of the previous bubble… what does that tell us about the state of affairs for the markets in 2016?

And look… delinquencies are spiking on corporate loans from commercial banks… indicating that businesses (the same businesses that are issuing record amounts of garbage debt) are not paying banks back for corporate loans.

More and more this environment feels like late 2007/ early 2008: when the economy was in collapse but stocks held up on hopes that the Fed could maintain the bubble.

The time to prepare for this bubble to burst is now."

Graham Summers

Chief Market Strategist

Phoenix Capital Research

"The corporate bond market is a time bomb waiting to go off.

It took the US half a century to grow its corporate bond market to $3 trillion.

Thanks to the Fed implementing ZIRP and holding rates there for seven years, we’ve doubled the corporate bond market, adding another $3 trillion in corporate debt… since 2009.

These bonds are junk… literally. The average credit rating is junk. All told, since 2012, 75% of companies accessing the bond market have had a credit rating of single-B.

So… if the corporate bond market is now TWICE as large as it was in 2008. And the quality of the bonds is lower than it was at the PEAK of the previous bubble… what does that tell us about the state of affairs for the markets in 2016?

And look… delinquencies are spiking on corporate loans from commercial banks… indicating that businesses (the same businesses that are issuing record amounts of garbage debt) are not paying banks back for corporate loans.

More and more this environment feels like late 2007/ early 2008: when the economy was in collapse but stocks held up on hopes that the Fed could maintain the bubble.

The time to prepare for this bubble to burst is now."

Graham Summers

Chief Market Strategist

Phoenix Capital Research

Sunday, May 22, 2016

"This Hasn't Happened Since the Great Crisis"

May 17, 2016

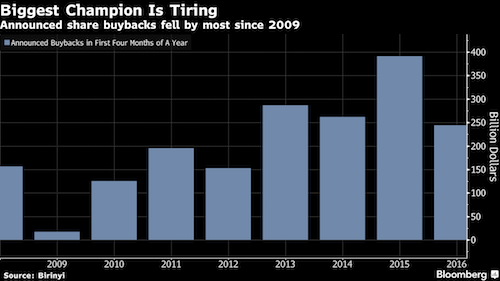

"Stocks are now officially on borrowed time.

Corporate buybacks have been the single largest driver of stock prices in the last quarter. Institutional investors have been net sellers for 15 weeks. And individual investors have been pulling capital out of stock funds in record amounts.

This leaves corporate

buybacks as the sole driver of stocks. But now that is ending.

Announced buybacks

plunged 34% in 1Q16. This is the single largest plunge in announcements

since 2009.

Now, this does not mean buybacks are drying up all at once. As you can see in the chart above, there were a record number of buybacks announced in 2015. Those plans are beginning to be implemented.

So there will be a significant degree of corporate buybacks going forward.

However, buyback announcements and actual purchases are not the same thing. Many times companies announce buyback programs that they later fail to complete.

Meanwhile, earnings are collapsing, while stocks remain near all-time highs.

This whole mess feels just like the end of 2007 or beginning of 2008 to me.

The time to prepare for this bubble to burst is now. Imagine if you'd prepared for the 2008 Crash back in late 2007?..."

Graham Summers

Chief Market

Strategist

Phoenix Capital

Research

Friday, April 8, 2016

Tuesday, March 22, 2016

Why wait until it's been 20-30 years and it collapses...worthless. Is it time for your life insurance audit? From a foundation of ignorance...there is a wave coming...is your life insurance even competent?

"Is there a life insurance bubble that is about to go bust?

Life insurance buyers have two main options: term insurance that only pays if you die, or an insurance policy that has a savings or investment feature. That is often called universal or whole life. It's those types of policies, universal and whole life that we are talking about.

Transamerca Corporation no longer has its headquarters in the iconic Transamerca pyramid in downtown San Francisco. The signature building is still a part of the companies logo along with the words, "Transform tomorrow."

Mary and Gordon Feller bought Transamerica policies back in the 1980s and say the company has indeed transformed their tomorrow.

"The projections we were given were based on eight percent interest rate and there was never a time where the policies earned eight percent," Mary Feller said. "Now, suddenly the cost of the insurance has skyrocketed. So when we put in $250 or $500 or $700, or whatever we put in on that quarterly basis, that money is eaten up."

"Well, here we are 25 years later. The baby boomer generation is ready to retire. Now the companies say, 'Whoa, we've got to make good on our promise? No, we're walking away,'" said the Feller's attorney Harvey Rosenfield...."

LINK

Monday, March 7, 2016

"Is This Entire Rally Just One Big TRAP?"

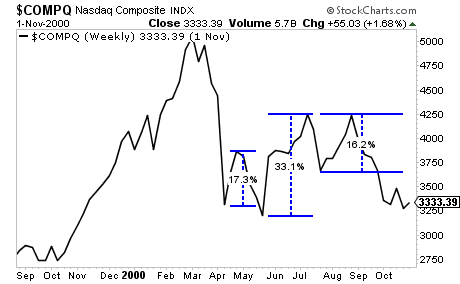

"Few analysts realize that the sharpest, most aggressive rallies occur during bear markets. The reason for this is that during bear markets, investors tend to go short (borrow shares to bet on a collapse).

So when the market rallies even a little bit, it often will go absolutely vertical as these individuals panic and cover their shorts (which increases the buying power of the move).

Consider the Tech Bubble. When it burst, we had THREE monster rallies of 17%, 33% and 16% in just SIX months time!

Anyone who bought into these moves for the long-term ended up get crushed as the market soon rolled over and worked its way down.

The below chart gives some perspective on just how much further stocks would fall relative to these bull traps!

Smart investors, however, used those rallies to prep for the next round of the drop. They didn’t get suckered into believing that it was the beginning of the next bull market...."

Graham Summers, Phoenix Capital Research

Tuesday, March 1, 2016

Friday, February 26, 2016

My Mutual Disability Insurance Policy vs. Your Medical Association Discount Policy: It Matters

(Photo credit: Werner Elmker, Fairfield, Iowa)

(This is the first article in a series on income protection / disability insurance. It is a somewhat condensed version of a series of articles to come.)

The number one thing to understand about insurance is that quality is not available without personal service. It’s simply too complex. Try to find quality on the internet. I have. Each person’s financial circumstance is unique. In my experience, the internet products are not only inadequate, they are not even comparable…but they are…beguiling.

First, let’s briefly ask the question: WHY do you want income protection?

Your ability to work is the most valuable asset you own.

Let’s prove it.

Earning 200k per year for the next 35 years is a $7M ASSET.

If you owned a $7M home, would you insure it?

Now, let’s compare two sample disability insurance policies. We’ll call them My Mutual and My Medical Association Discount policies. Let’s see how well they protect your $7M asset, in the most critical provision in your entire policy—partial or temporary disability coverage.

PARTIAL DISABILITY BENEFITS?

- My Mutual Disability Policy: Yes. The Gold Standard.

- Medical Association Discount: Yes. Kind of….

What do you think is more likely to happen during your working lifetime: 100% disability with an inability to do anything, permanently?

… OR …

Temporary (i.e. serious illness, then recovery) or partial disability?

Correct!

So where do you think you should have a STRONG contract in case you need it? This is THE MOST CRITICAL part of your disability insurance contract.

I cannot emphasize this enough!

The Medical Association Discount Policy will cover a loss in income if it exceeds 20% of your income. And ONLY IF you first receive benefits for TOTALdisability. (Read CAREFULLY.)

On the other hand, My Mutual DOES NOT REQUIRE TOTAL DISABILITY FIRST, for benefits. To qualify, they require 1 of 3 possibilities: loss of the ability to perform 1 main duty OR loss of 15% of your income OR the loss of 15% of your time.

On top of that, the MINIMUM they will pay you for the first 12 months is50% of your benefit or the actual loss, WHICHEVER IS GREATER.

After 12 months, benefits are proportionate to the loss of income. At any time,the full benefit will be paid if the loss is greater than 75%.

ANOTHER CRITICAL POINT for physicians. How will the insurance company determine how much my monthly benefit amount is?

Most disability insurers will only go back 12-24 months, maybe 3 years, often based on your tax return filings. Suppose the last couple of years were not so good, but prior to that your income was excellent.

You’ll like this.

My Mutual’s definition of pre-disability income is extraordinary: You have 3 choices:

- Average monthly income for the last 12 months; OR

- the last 24 months; OR

- ANY consecutive 24 months during the previous 60 months prior to disability

WHICHEVER IS HIGHEST!

What about inflation?

At 44 years old (if disabled at 35) with 3.1% inflation, you will need DOUBLEyour monthly income just to maintain your initial standard of living.

My Mutual’s policy will increase your pre-disability income (by which your benefit is calculated) DURING your disability, by a MINIMUM of 3% and aMAXIMUM of No Cap. Nobody competes with that - let alone an internet policy.

It’s the gold standard for a reason.

Remember, you will not realize this until it is too late.

It’s almost as if someone actually took the time to THINK, “Hmm…what is the most critical piece of a disability insurance policy? And how can we make it the STRONGEST part, the foundation of our coverage?”

Imagine that!

Thinking about benefiting policyholders as opposed to “How can we defend ourselves against claims and increase our (short-term) profits (to please Wall Street)?”

Who do you want standing behind you?

I know who I want.

Can anyone compete with My Mutual?

In the most critical areas?

I don’t know.

But I’ve yet to see it, and doubt it.

(I’ve got the spreadsheets.)

Talk to someone who seriously cares. Someone who ENJOYS discerning details. Details that matter TO YOU.

As a busy physician, I’d want the kind of person I’m confident is already turning over every rock so I don’t have to. That’s what you do for your patients. You expect the same.

… OR …

Learn a “new specialty” in your “spare” time (not!).

What is the take-away?

FUNDAMENTALLY, realize that all accurate actuarial calculations are the SAME. That is, THERE ARE NO REAL DISCOUNTS IN INSURANCE WITHOUT CUTTING BENEFITS! There is just sales and marketing…to beguile you.

Good pricing can only be accomplished by outstanding underwriting, comprehension, and control of one’s risk pool. As history shows, indiscriminate “marketing discounts” have put many a youthful insurer into rehabilitation… especially during an economic downturn.

If you want to insure the most critical asset you own, you don’t look casually.

If the price is too good, then get out your magnifying glass and waste a day (or more) on becoming a contracts lawyer. Even then, it’s still hard to catch all the fine points, because this is NOT your niche.

Better: Find a specialist. Your time is valuable. And time off matters to your performance in growing the most valuable asset you own - your ability to work.

If professional discernment matters, find someone who thinks like you do. Who turns over every rock and inventories the entomological fauna before advancing.

Make sure he won’t settle for anything less than an A++, in anything… because you won’t either. That’s why people entrust you…with their breath.

FOR FURTHER

INFORMATION OR QUESTIONS, PLEASE CONTACT:

Robert S. Park, M.D.

Life Insurance+

Seattle, Washington

(206) 395-9501

wealth | estate | business planning

“Twenty years

from now you will be more disappointed by the things you didn’t do than by the

ones you did.” Mark Twain

Preserving your Savings in Safety

Subscribe to:

Comments (Atom)