May 17, 2016

"Stocks are now officially on borrowed time.

Corporate buybacks have been the single largest driver of stock prices in the last quarter. Institutional investors have been net sellers for 15 weeks. And individual investors have been pulling capital out of stock funds in record amounts.

This leaves corporate

buybacks as the sole driver of stocks. But now that is ending.

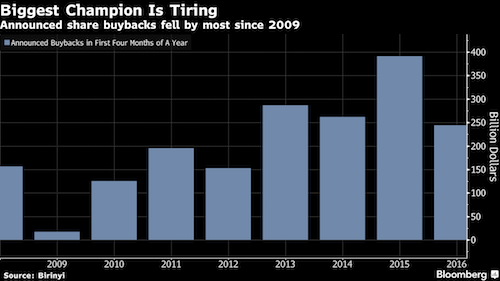

Announced buybacks

plunged 34% in 1Q16. This is the single largest plunge in announcements

since 2009.

Now, this does not mean buybacks are drying up all at once. As you can see in the chart above, there were a record number of buybacks announced in 2015. Those plans are beginning to be implemented.

So there will be a significant degree of corporate buybacks going forward.

However, buyback announcements and actual purchases are not the same thing. Many times companies announce buyback programs that they later fail to complete.

Meanwhile, earnings are collapsing, while stocks remain near all-time highs.

This whole mess feels just like the end of 2007 or beginning of 2008 to me.

The time to prepare for this bubble to burst is now. Imagine if you'd prepared for the 2008 Crash back in late 2007?..."

Graham Summers

Chief Market

Strategist

Phoenix Capital

Research

No comments:

Post a Comment