"Few analysts realize that the sharpest, most aggressive rallies occur during bear markets. The reason for this is that during bear markets, investors tend to go short (borrow shares to bet on a collapse).

So when the market rallies even a little bit, it often will go absolutely vertical as these individuals panic and cover their shorts (which increases the buying power of the move).

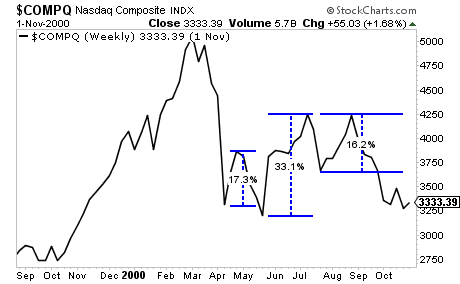

Consider the Tech Bubble. When it burst, we had THREE monster rallies of 17%, 33% and 16% in just SIX months time!

Anyone who bought into these moves for the long-term ended up get crushed as the market soon rolled over and worked its way down.

The below chart gives some perspective on just how much further stocks would fall relative to these bull traps!

Smart investors, however, used those rallies to prep for the next round of the drop. They didn’t get suckered into believing that it was the beginning of the next bull market...."

Graham Summers, Phoenix Capital Research

No comments:

Post a Comment