Ben Bernanke, like Alan Greenspan before him, is now concerned about his legacy.

To that end, he’s begun writing a blog that, as one would expect, is largely a defense of his actions, even though the Fed’s OWN research shows that he’s either lying or an idiot.

To that end, QE cost income-focused retirees and savers over $470 billion and, at best, lowered unemployment by 0.13%. Beyond this, the Fed’s actions under Bernanke’s leadership, ignited the biggest inflationary bubble in history.

Bernanke HATES deflation, not because he likes paying more for a house or car or food or anything else… but because DEBT deflation would render the big Wall Street Banks insolvent.

Ben, while delusional and dishonest, is not entirely dumb. He knew which side of the bread was buttered for him and his masters. So he was only too happy to inflate the heck out of the financial system to insure that Wall Street could leverage up as much as possible.

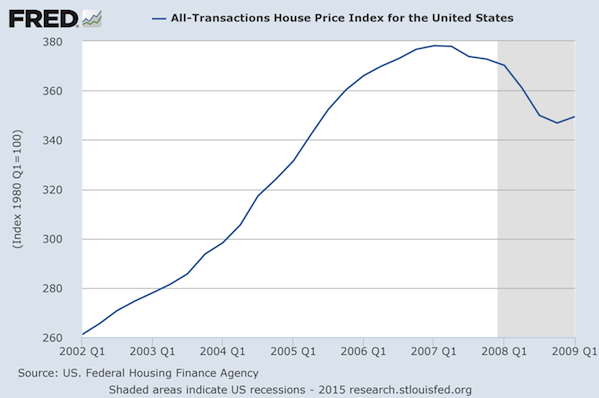

Consider what happened to prices of various assets during the Greenspan/ Bernanke fed (Bernanke was hired by Greenspan in 2002).

Here's housing:

After pricing most Americans out of the housing market, Bernanke facilitated the biggest housing Crash in 100 years.

Here’s what happened to food prices.

![%%%%%%%].png %%%%%%%].png](https://d1yoaun8syyxxt.cloudfront.net/phoenixcapital-22b8b368-55e2-4f46-b5f0-fd06952c65c7-v2)

If you required food to live, you spent an ever larger amount of your income doing so.

Here’s what happened to oil prices. Remember, oil or oil derivatives are present in lipstick, Vaseline, solar panels, polyester (stain resistant clothes), chewing gum, crayons, Aspirin, pantyhose, sneakers, detergent, CDs, plastics of any kind, food additives, fertilizers, pesticides, candles, milk cartons, pen ink, and more. This move in prices affected ALL of those industries.

Bubbles and Crashes. But mostly bubbles.

And here’s what happened to stocks.

Bubbles and Crashes.

All of the above items indicate intense inflation, not deflation. We did have ONE deflationary period that lasted a total of 7 months, but the fact remains that Bernanke was a deflation expert who helped manufacture one of the greatest periods of inflation in history. The actual suffering unleashed by this period is staggering. You cannot argue with those charts: LIFE IN GENERAL BECAME MORE UNAFFORDABLE FOR AMERICANS under Bernanke.

Bernanke didn’t care. He had to appease his Wall Street masters… not to mention the US Government which went on an unprecedented spending spree during his tenure, racking up an unheard of $18 TRILLION in debt, with total debt TRIPLING.

In short, Bernanke bankrupted the US and most Americans in the span of ten years. He created the biggest housing bubble in 100 years and also casue the greatest Crash in 100 years. A few blog entries won’t change this.

And his actions post-2008 set the stage for an even bigger crisis than 2008. When 2008 hit, the Fed became even more aggressive in its loose monetary policy. The US now sports a Debt to GDP of over 100%. The Fed's balance sheet is over $4 trillion with no possible way of exiting (the Fed cannot transfer assets as they were bought via POMOs not repos...). The next time a crisis hits... it won't just be Wall Street that implodes.

Graham Summers

Phoenix Capital Research

No comments:

Post a Comment